War - What is it good for?

Do you remember “The Temptations” from the 1970’s, or “Frankie Goes to Hollywood” from the 1980’s … two defining decades, when both the music and fashions were simply exceptional!

The song “War” (performed by both bands), challenged; “What is it good for?” Originally conceived to protest the Vietnam War, it was the first Motown song to make a political statement. It hoped to convey a message of finding greater harmony in our lives.

Sadly, war has been a constant throughout human history, but it’s not always man-made. Today’s war is with Covid-19, and it is for many as devastating as any human conflict. The good news is that on this occasion, we’re not destroying one another. However, without the massive intervention of Government and Central Banks the social damage could mutate into a far more sinister event and so the battle today requires that Governments preserve as best they can our economies. Consequently, we may steal from future generations, some of their purchasing power parity - as has often happened throughout history.

Between 1914 and 1918 the world was at war. Fast forward to 1939, and once again the world was at war. In these conventional conflicts, the game requires that a funder lends to Government, capital with which to win the fight. This is the Central Bank and these days, the extra “money” is all electronic (in years past it was “printed”). By creating more money, we risk devaluing its value tomorrow - effectively robbing our children’s wealth (as such) in a bid to pay for today’s survival (and we’ll deal with tomorrows wealth…well, tomorrow!). Modern Money Theorists (MMT) would argue that this time around, with no Gold Standard to debase from, the system can be more easily managed/preserved. They may be right...

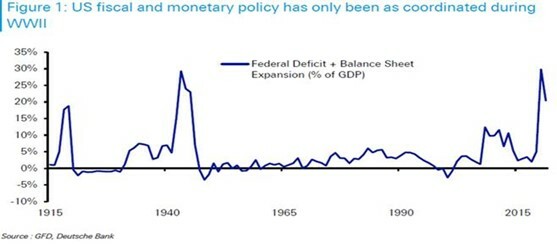

War is expensive - and when it's on a planetary scale, the stakes are never higher. So, it requires an extraordinary response. Over two World Wars you can see (below) the coordinated reaction of Fiscal and Monetary policy in the USA. Observe the coordinated response to the war currently being fought:

It’s not quite this simple but: Fiscal policy drives the level of Government spending and tax in the economy - while Monetary policy reflects the volume of money and interest costs. The detail of how it’s managed is complex and what’s critical in this, is that the economy remains “sufficient” to at least muddle along.

Looking at the historically significant occasions above and after such extreme Government responses, there has generally been a period of great prosperity (before the next crisis). While we cannot know when the next “crunch” will be, we can observe the wealth resulting from each recovery, thus the cycle continues and almost assuredly, the next generation will still find a path to make its own way into history.

Tony Munro | CFPCM, Post Grad Dip. Bus.Studies (PFP), FSP 5501

The views and opinions expressed in this article are intended to be of a general nature and do not constitute personalised advice for an individual client. A disclosure statement is available on request and free of charge.