Rent or Own - is it that obvious?

A retired doctor for whom I work recently asked me an interesting question - should they buy a new home or should they rent? The answer provided some compelling insights…

Background

Having just sold their mortgage free home of 30+ years in the South Island, sadly, the proceeds of that are simply not enough for them to buy into the more expensive Auckland/Northland market, where they wish to live closer to family. Consequently, they’re having to contemplate dipping into their retirement nest egg if they are to own their next home.

Psychologically, I know I would prefer to buy, but from a purely financial perspective, I believe renting has much merit. The question is often emotional, it’s a feeling of security, of having control... A wise person once said to me, “We’re all just renting (you can’t take any assets with you to the afterlife)”.

Theological discussions aside, in this world, I would be reluctant to embrace a rental option in retirement, unless I could secure something like a three-year lease (or more) and a right of renewal for say three more years. This couple are in their mid 70’s and as we talked, I quipped that “Real property investors should crave long-term tenancies”. Long term leases are common in many European communities, but not so here in New Zealand - something the industry must surely address.

I conveyed that, despite all the property bulls talking prices up, residential house prices may not move all that much higher in the next few years… I then saw this article on Stuff, which supported that view: https://www.stuff.co.nz/money/350176470/house-prices-double-10-years-can-it-continue

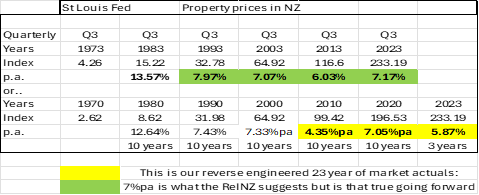

No one knows what happens tomorrow. I’ve been a financial planner for 33 years. Compared to much of the rest of the world, and acknowledging the bull’s arguments (housing shortages, desirable place to live etc etc), I think house prices in this country look ‘crazy high’ and my feeling is that for the decade ahead the market will be more like the period 2000-2010, when house prices grew by 4.3% pa. During this decade, mortgage rates were much closer to today’s offers but, coming out of the Global Financial Crisis, interest costs drifted lower. That, combined with loose monetary stimulus saw house prices push higher, along with the nation’s overall indebtedness.

Data from the St Louis Fed suggests that an “average” NZ house purchased in the third quarter of the year 2000 for, say $200,000, would have appreciated to $718,000 by Q3 2023. Having been active in the market myself during this period, intuitively these numbers sound about right. So, in year 2000, assuming the bank required a 20% deposit and interest rates were sitting at around 8% p.a. for a 30-year loan, the required deposit would be $40,000. Repayments on the $160,000 borrowed would have been $270pw. An attainable servicing requirement I would think.

For the family buying Q3 2023 – for the very same house (now twenty-three years older), they’re required to find a deposit of approx $145,000. The mortgage cost would be $972pw. Yes, $50,544 p.a. post-tax is required to service $575,000 borrowed, and there’s still the cost of rates, insurance and any future repairs or maintenance to cover. All this for an “average” house…not so attainable!

If we assume the next 23 years delivers to the NZ residential real estate market the same gains we’ve experienced in the last 23 years, then the “average” house in this country will be worth $2,578,000 by 2046. A 20% deposit of $515,500 would have to be saved and weekly mortgage repayments would be $3,492p.w. That requires debt servicing of $181,600 p.a. (and still the holding costs to pay)!

Projecting the last 30 years actual price data into the future, suggests by year 2053, an average house will cost $5,105,000. Or, using 40 years of data (1983 to 2023) as our forward proxy for what may happen (2023 to 2063), and we find the price of an average Kiwi house explodes to $11,000,000! That sounds unimaginable, somewhat nonsensical and if it were to transpire, then NZ may well stand for New Zimbabwe…

Stats from the St Louis Fed:

Back to my client - Having sold in the South Island, they have combined savings/investments of $1.6M available to purchase their new home. So if they buy in Auckland for $1.2M, they’ll have around $400,000 remaining in their retirement portfolio to supplement their pension, to maintain the lifestyle they have become accustomed to. Or, alternatively, they rent.

The rental property they are considering is superior to the unit they’re thinking of buying. The renting option is $750pw. It seems a lot – $39,000 a year. On the plus side though, there won’t be any further outgoings (no rates, no house insurance, no repairs or maintenance etc).

To generate $39,000 a year from $1.6M invested, a net, after tax return on capital of 2.44%p.a. would be required (hardly a high hurdle). Financial markets ebb and flow. So, in some years income or capital will cover the rent and in other years, they’d accrue more in total gains than is needed.

If we assume a Balanced (60/40) strategy for a retired couple (not too hot, not too cold – just right), then much history suggests that we should expect a return in a range of 4-6%pa net. Let’s say 5% is the annual average. As an average, that’s $80,000 a year. Acknowledging inflation, we may need to generate higher returns in inflationary environments (the good news is, interest rates tend to rise to mitigate rising inflation, as is currently the case). So, naturally, they would generate more income to cover rising rent. When inflation falls, interest rates ultimately fall, and rents won’t rise as much.

If $80,000 is the average net annual up-side (5% p.a. from above), then allowing for the rental cost, my clients can freely spend the remaining $41,000 to supplement their pension and maintain their active lifestyle. With the $1.6M still intact, they may want to further increase their standard of living and gradually use more of their retirement nest egg… especially now while they’re younger. They’ve got choices and options with a liquid investment portfolio.

Alternatively, if they buy a house and, if house values do rise (is 7%p.a. still likely?), this rising value is locked up in the house. They can’t just shave a piece off. They either sell the house or release value via a Reverse Annuity Mortgage, which are generally costly and ideally, a last resort.

Conclusion

I became a financial adviser in 1991. I recall residential property had, for decades prior, appreciated by the rate of inflation plus one to two percent p.a. In December 1990, NZ household debt (mums and dads) as a percentage of Nominal GDP was recorded as being just 27.8%. Today it stands at 91.5% (source: Ceiddata.com). Since 1990, NZ house price inflation has averaged around 7% p.a., largely fuelled by falling interest rates and rising debt levels. Wages have also risen but by no means as much as house values. Statista.com tells us since 2015, house price growth has outpaced income growth by some 32%.

Bottomline, the average house price in New Zealand has risen at more than twice the rate of inflation, hence why we are here in 2024, with housing and the cost of living still the major issues of the day.

As to the dilemma of rent v buy: If history is our guide, then we should leverage to the gunnels and own lots of houses - as prices have doubled every ten years since 1990 (ignoring all associated costs). This strategy blindly assumes conditions of the last thirty years will prevail, even though prices are now 7 times higher.

Today the math is glaringly apparent – rent. In this example, half the cost of servicing a mortgage gets a better home when renting instead. But my DNA (just like yours), screams: own! The problem is: security. In New Zealand, we have a massive disincentive to rent, as we will feel like we’re at the mercy of the landlord. The Government should possibly stop tinkering with ownership taxes and instead, maybe incentivise landlords to offer longer-term leases, thereby giving tenants more certainty, and arguably, more obligations, but also a sense of ownership. Leases, of course, could also be bought and sold. We need to satisfy the fundamental need for people to feel secure, long-term. That doesn’t necessarily mean ownership. If we can somehow find a solution to that, then quite possibly more people would rent, both landlord and tenant have more certainty, and ultimately, there is more money to spend on things other than the escalating costs of ownership (rates, insurances, interest etc), benefiting the economy overall.

The views and opinions expressed in this article are intended to be of a general nature and do not constitute personalised advice for an individual client.