"No Frills" or "Choices" Retirement?

How would you like to see your spending in retirement?

Massey University’s Financial Education Centre has just released its annual Retirement Expenditure Guidelines to June 2023 – these show that for a two-person household of over 65 year-olds, the cost of a "No Frills" lifestyle (in a city) is $982pw (costing $219pw more than the NZ Super currently paid to a couple); or $1,665pw for a “Choices” lifestyle (a $902pw gap!).

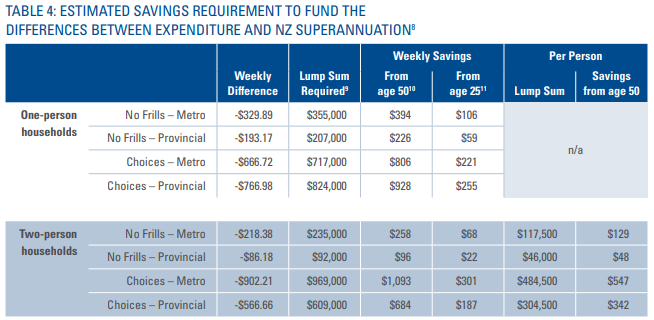

The University estimates the retirement ‘nest egg’ needed for a couple ranges from $92,000 (for a “No Frills”, provincial lifestyle) to $969,000 (for a “Choices”, city lifestyle).

The below table from the report reflects the savings strategies required to meet the various targets:

Currently 17% of NZ's population is aged 65 years or older, and this number is steadily increasing. Do we really think that the NZ Super is sustainable in its present form?

Most Kiwis aspire to achieve a better standard of living in retirement than can be supported by the NZ Super, and so we’d need a freehold home and almost $1million by age 65.

But - this money shouldn’t just be sitting in a bank account; it should be working for you.

If the cost of the goods and services we need in retirement rises by an average of 4%p.a, then in ten years the purchasing power of this capital is just $654,622. Losing the spending power of $314,378 could be just as brutal as experiencing a 32% realised loss in share markets (the key is to not realise losses from investing, from having to sell in a down market, as that's a sure-fire way to reduce your lifestyle).

Balancing off short and long-term risks is a financial planning exercise; it’s about knowing your goals and objectives and tailoring both the accumulation and subsequent drawdown strategy. There are plenty of places offering to give advice or sell product – few offer independent advice. Contact us today, and we can help you get on the right path.

The views and opinions expressed in this article are intended to be of a general nature and do not constitute personalised advice for an individual client.