Coronavirus, recession, election, trade wars, interest rates... Should we be worried?

The answer of course is “yes”, but as my wife would tell me (and I think she took this one from someone else); “Worry is a wasted emotion”. She’s right of course, but it doesn’t stop a very human response to some concerning trends. To my mind, the Coronavirus might well be the “Black Swan” event that shifts investor sentiment… but only for a while.

A black swan is an unpredictable event that is beyond what is normally expected of a situation and has potentially severe consequences.

What follows are two articles from last year - let's step into my time machine, to take us back to 14 January 2019 - when I wrote the following:

Don't make the classic investor mistake - 14 Jan 2019

Now is not the time to be selling or shying away from good investments. It’s a time for buying, with a cautious eye. Good management plan for highs and lows & they adjust their strategy to meet the market. Some shareholders may choose to sell, which may push prices down (but of course, someone is buying at this new price). Then, as sentiment slowly changes, prices push up as more buyers enter. The fact that we can buy or sell on any day, reflects the more extreme shifts that can occur in listed asset prices. So ultimately, we should question; “Are we buying Shares, or are we buying Businesses”? It is an important distinction.

The returns from Cash or Fixed Interest will never return enough to combat long term tax or inflation effects (and I don’t see that changing any time soon). So, if we’re not buying businesses, then the alternative is to buy real estate and yet, that sector is by no means cheap either.

Property is traditionally less volatile than Share Markets, because it does not have the liquidity of Shares. It therefore feels safer, but truly, this is illusionary. If we sell at the wrong time, this asset class is every bit as risky, indeed more so if leveraged (in debt) and if little of that mortgage has been repaid prior to its forced sale (the bank will always get its capital back first, with very little sympathy for timing, unless it is to their benefit).

In the short term the only certainty is uncertainty, hence why we diversify. We place different eggs into different baskets as we try to avoid making mistakes. We buy what good research suggests is quality. To succeed, we develop a plan and we stick to the strategy, beyond just today’s price.

The US Dow Jones Index recorded its worst December since 1931 and for the first time ever, 2018 saw December deliver the worst returns of any month during the year. With headlines dominated by trade wars, a US government shut down, Brexit and the Federal Reserve shrinking its balance sheet & hiking interest rates, the Dow Jones Index finished the month down 8.7%, while Australian shares recorded their worst December-quarter since 2011. The question is whether 2019 will deliver worse things, or rather will it be a year of opportunity.

The potential for policy error in areas such as trade between the US and China is offering more fuel for the “Bears” out there. Unfortunately, this backdrop presented itself in the last quarter of 2018, with almost all major stock exchanges finishing the year in negative territory. The US S&P500 closed the year down just over 6% whilst the Shanghai Index and the UK’s FTSE100 Index fell by 25% and 12% respectively. Commodities faced similar treatment with Copper down 20% and Crude Oil collapsing 24%!

There is a heightened level of disagreement amongst investors and commentators as to what the medium-term outcomes will be. Although the noise surrounding international politics and central banks seems louder than ever, equity market fundamentals in general appear supportive.

In closing: Investing today is about future returns. Capital to be used today should be extracted from Cash or Fixed Deposit holdings (the short-term stuff). Our “investments” are doing exactly as we’d expect, and given the last quarter was one of those challenging periods we’ve warned about before, now is not the time to make large reductions (indeed, this may well prove to be the best time to be buying more…).

Back to today

A year ago, our message was; It’s been a tough year. Don’t be drawn into the despair of the media. The fundamentals still look good and if we can see past the present volatility, we think there are still good returns to be had. But we also said, let’s be diversified and let’s take a long-term view. As professional advisers, we did exactly that and 2019 was one of the best years (observe the Mercer Periodic Table that follows). So, what’s going to happen now?

I started this communication with the question; “Should we be worried”?

Wasted emotion or not, I do worry and that worry makes me cautious. But I worry in both the good times and the bad, it’s my job to do the worrying because that’s what a prudent person should do. The trick is to be cautious at the right times and bold at the right times. For all of us, investing is about future returns, it’s not about today’s return. Indeed, for many of us, we’re influenced to buy today’s investment because of yesterday’s return (though yesterday has already passed, so what good does that do for tomorrows result?). Let’s get back to our Black Swan.

I’m very confident that the world will get over the Coronavirus, but I would not be surprised if as a result of escalating trade interruption, the world economy begins to contract. That may see Central Banks then holding interest rates low (or lower) and for Governments to escalate fiscal responses. My concern is the amount of leverage present in the global economy may just be too much. I wonder, what are the tipping points for those businesses exposed to the bottle necks of Corona’s flow on effect? What happens if they begin to lay off staff? What happens for those displaced workers with large debts, who then begin to miss their mortgage repayments? What happens to the value of those assets if they need to be quickly sold? It could all turn rather nasty very quickly.

So – how should we respond, if we have these feelings of foreboding? We wrote the answers about that in 2018…

The days you don't want to miss

Article adopted from: https://www.thesimpledollar.com/investing/stocks/tempted-to-sell-missing-just-a-handful-of-the-best-stock-market-days-can-tank-your-returns

The stock market can be a wild ride. Swings of 20-30% in value during short but volatile periods are not uncommon. Let’s take a look at what would happen if you tried to “time” the market, to be out before the big “crash” and in so doing, also ended up missing out on the days which delivered the biggest recoveries? Now you might argue that it’s better to miss the sharp fall than to catch the slow ride, then experience the bounce recovery. Both are as difficult as each other to predict.

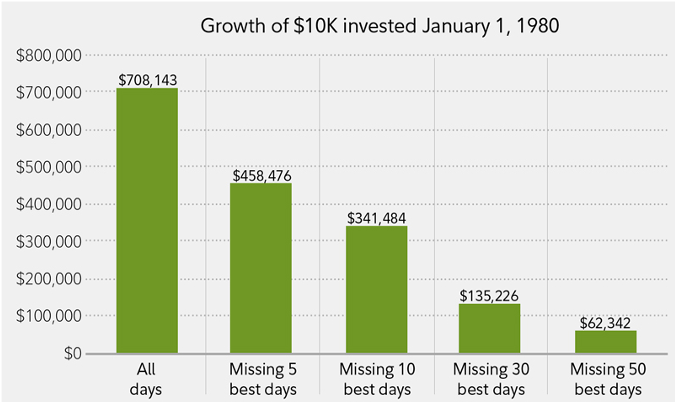

Long story short, Fidelity ran the numbers on what would happen to a hypothetical $10,000 invested into the S&P500 index from 1980 to 2018. Now, as an American based index there is no consideration for the relative pricing of USD/NZD during this period and “timing” the currency well or badly has a more or less beneficial outcome for a Kiwi investor. The data reflected here is USD:

Quite aside of what $10,000 actually bought in 1980, by just missing the best 10 days of the market over 38 years, this dropped the total return by a whopping 52%! (taxes & fees are ignored.) This very good result was achieved just by investing in the index (not so easy to do in 1980). Imagine how well we’d have done beating the index!?

Hindsight is perfect - the chart adjacent tracks a 38-year period, or roughly 10,000 days of stock trading. Anyone who thinks they can “time” the market, getting in or out without missing the meaningful returns, is only fooling themselves. Some of the best days have come about during and immediately subsequent to the worst days and those days of the recovery are impossible to identify… except in hindsight. So, stay in the markets!

Financial markets since 1980 have been anything but predictable. How many “Black Swans” eventuated over the last forty years? With perfect foresight, where would you have invested? The answer is varied, and it absolutely includes share markets.

Monitoring and adjusting the portfolio periodically is an essential part of a successful investment process, because few investors are content to set and forget their life’s savings into one strategy for 38 years. Complicating this is that most of us don’t have a fortune to invest on the first day (investing is often a gradual process of building up resources, ready to commit, with a media fraught with misleading data and news headlines).

To avoid the noise investors simply have to decide if they’re long-term in their view (today) or short-term in their view (today). If their goals are both long-term and short-term, then a bob each way is balanced. How much they need in the short-term should dictate the degree of defensiveness. For everything else, the long-term delivers the best returns. It’s been a very successful decade for investors, but not always plain sailing. Where do you think returns will be for 2020? Which investment sector will be this year’s winner and which, this year’s loser?